What Is Medicare Part D? Prescription Drug Coverage Explained

If you’re turning 65 in California or helping someone who is, Medicare Part D is a big piece of the healthcare puzzle. It helps cover the cost of prescription drugs and knowing how it works can help you avoid penalties, plan better, and save money.

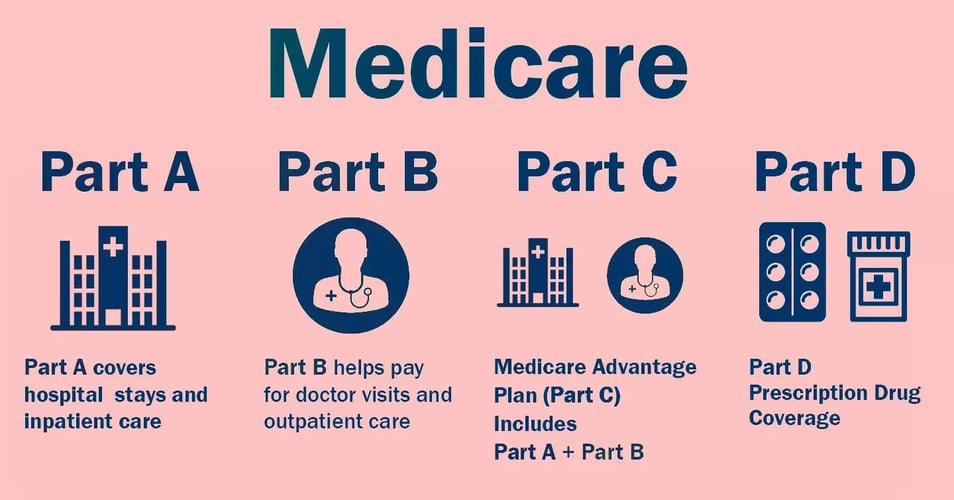

What Is Medicare Part D?

Medicare Part D is your prescription drug coverage. It helps pay for both brand-name and generic medications, making the cost of prescriptions more manageable. It’s not automatically included with Original Medicare, so you’ll need to sign up separately.

Who Offers Part D and How Do You Enroll?

Medicare Part D is offered by private insurance companies approved by Medicare. You can buy it as a standalone drug plan (if you have Original Medicare), or it might be bundled with a Medicare Advantage plan that includes drug coverage.

You can enroll when you’re first eligible, during your Initial Enrollment Period, or during the Annual Enrollment Period from October 15 to December 7. You may also qualify for a Special Enrollment Period in certain situations, like losing employer coverage.

What Does It Cover?

All Medicare Part D plans must cover a wide range of drugs, including most medications used to treat common and serious conditions. These include cancer drugs, insulin, mental health medications, and more. Coverage details (called a formulary) can vary, so it’s important to compare plans.

How Much Does Medicare Part D Cost in 2025?

Premiums vary by plan and provider. In 2025, the average monthly premium is expected to stay stable, but your cost may be higher based on your income.

If your income is above a certain amount, you may pay more due to IRMAA (Income-Related Monthly Adjustment Amount). This amount is added to your monthly premium and billed by Social Security.

What Happens If You Delay Enrollment?

If you don’t have creditable prescription drug coverage (such as from an employer or union plan) and delay enrolling in Part D for 63 days or more, you may face a late enrollment penalty. This penalty is added to your premium and it doesn’t go away.

Make sure to get written confirmation if your other coverage is considered creditable to avoid this costly mistake.

Extra Help and the Low-Income Subsidy (LIS)

For those with limited income and resources, Medicare offers Extra Help, also known as the Low-Income Subsidy (LIS). This program helps reduce or even eliminate your Part D premiums, deductibles, and copays. In many cases, it also protects you from the late enrollment penalty.

Eligibility is based on your income and asset levels. In 2025, many beneficiaries will automatically qualify if they’re enrolled in Medi-Cal or receive Supplemental Security Income (SSI), but others can apply directly through Social Security. If you qualify, Extra Help can save you thousands each year.

What Changed Under the Inflation Reduction Act?

The Inflation Reduction Act (IRA) is a federal law passed to lower healthcare and prescription drug costs for Americans, especially seniors. It brought sweeping changes to Medicare Part D, including:

-

Insulin copays capped at $35/month, regardless of plan

-

Vaccines like shingles and Tdap now free, with no deductible or cost-sharing

-

Out-of-pocket prescription drug costs capped at $2,000 annually starting in 2025

-

Elimination of the 5% coinsurance for catastrophic drug costs

These improvements make it easier to budget for prescription drugs and protect beneficiaries from runaway costs. It’s one of the biggest changes to Medicare Part D since the program began and it’s especially meaningful for California residents managing chronic conditions.

Final Thoughts

Whether you’re in Los Angeles, Ventura County, or the San Fernando Valley, or anywhere else in California, choosing the right Medicare Part D plan can make a big difference in your health and your wallet. Understanding your options and the recent changes can help you avoid penalties and make smart choices.

Have questions or need help comparing plans? Click the button below to schedule a free consultation with a licensed California Medicare expert.

Not in California? I’m also licensed in Arizona, Florida, Georgia, Illinois, Michigan, Nevada, New Mexico, Oklahoma, and Texas and happy to help wherever you're located.

—

FYInsurance Solutions – Coach. Strategize. Protect.