Medicare Enrollment Timeline: Key Dates, Who Qualifies, and What to Do

If you're in California and turning 65, whether you're in Los Angeles, Ventura County, or the San Fernando Valley, understanding Medicare enrollment windows can save you money and stress. In fact, enrolling at the right time is just as important as choosing the right plan.

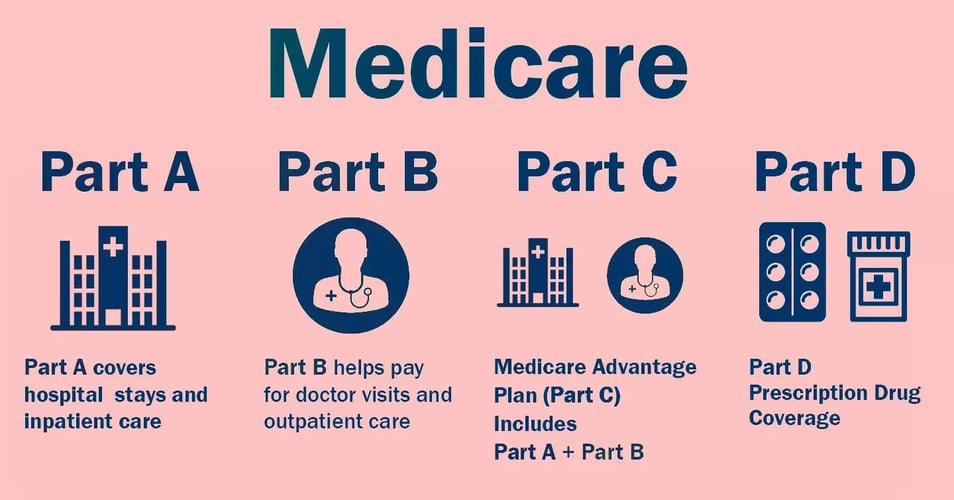

Who Gets Medicare?

You’re eligible at age 65 if you're a U.S. citizen or legal resident for at least five years. You can also qualify earlier if you’ve had Social Security Disability Insurance (SSDI) for two years or have conditions like End‑Stage Renal Disease (ESRD) or ALS.

What Is the Medicare Enrollment Timeline?

The Medicare enrollment timeline includes several windows for signing up or changing your coverage. Understanding which one applies to you can help you avoid penalties and secure the right plan.

1. Initial Enrollment Period (IEP)

This 7-month window begins 3 months before your 65th birthday, includes your birthday month, and ends 3 months after. Use it to enroll in Part A, Part B, a standalone Part D plan, and/or a Medicare Advantage plan.

2. Part D Initial Enrollment Period

If you want drug coverage outside a Medicare Advantage plan, you'll select a Part D plan during your IEP. Missing this window may lead to a lifetime late penalty unless you have creditable coverage.

3. Initial Coverage Election Period (ICEP)

For those choosing a Medicare Advantage plan (Part C), the ICEP starts when both Part A and Part B begin and lasts 3 months. This is your first chance to join MA or MAPD with no penalties.

4. General Enrollment Period (GEP)

If you miss the IEP, the GEP from January 1 to March 31 lets you sign up for Parts A and B. Coverage starts first day of the month following the month of enrollment and you may incur late enrollment penalties.

5. Annual Enrollment Period (AEP)

From October 15 to December 7, all Medicare beneficiaries can review, switch, or drop Part C or D plans. Changes take effect January 1.

6. Medigap Open Enrollment Period

Right after your Part B starts, you have a 6-month window to buy a Medigap (Supplement) policy without medical underwriting. Missing this period might mean higher premiums or denial due to pre-existing conditions.

7. Medicare Advantage Open Enrollment Period

If you’re already in an MA plan, you can use this window from January 1 to March 31 to switch plans or return to Original Medicare.

8. Special Enrollment Period (SEP)

Life changes, like retiring, moving, or losing job-based insurance, can trigger special windows to enroll without penalty. For example, if employer coverage ends, you’ll generally have 8 months to sign up for Part B, Part D, or Part C.

Why Timing Matters

The right timing avoids penalties, ensures ongoing coverage, and gives you access to Medigap plans without underwriting. A single missed window can lead to increased costs and hassle.

Final Thoughts

Medicare timing isn’t complicated; it just requires planning. If you're turning 65 soon, about to drop group coverage, or helping family members, use these windows to your advantage.

Click the button below to schedule your free consultation with a licensed and certified California Medicare expert.

Whether you need help with timelines, coverage options, or penalty avoidance, we’re here to support you.

Not in California? I’m also licensed in Arizona, Florida, Georgia, Illinois, Michigan, Nevada, New Mexico, Oklahoma, and Texas and happy to help wherever you’re located.

FYInsurance Solutions – Coach. Strategize. Protect.