What Is Medicare? A Beginner’s Guide for Californians Turning 65

If you’re turning 65 in California or helping a loved one navigate Medicare for the first time, it’s normal to feel overwhelmed. Medicare is a federal health insurance program designed to help older adults and people with certain disabilities afford the care they need. But understanding how it works and how to avoid penalties can save you time, money, and stress.

What Is Medicare?

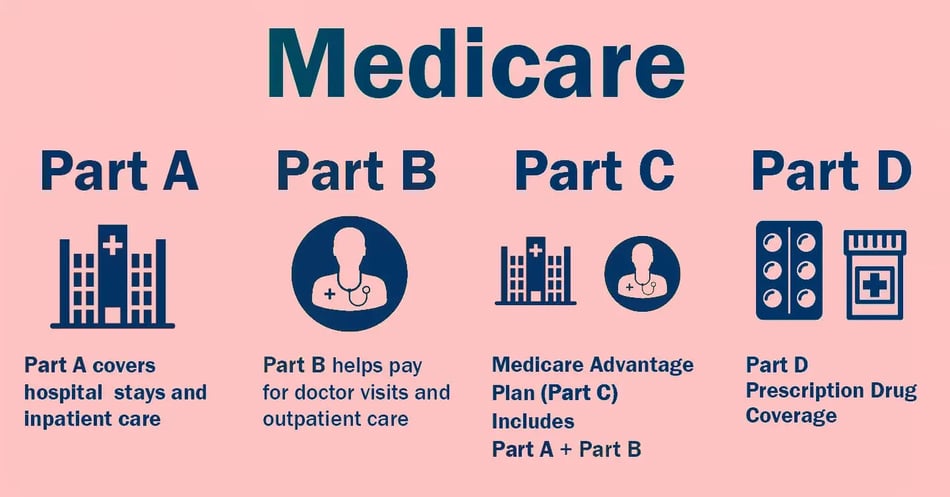

Medicare is the federal health insurance program for people age 65 and older, and for certain individuals under 65 with disabilities or specific conditions like End-Stage Renal Disease (ESRD). It's made up of different “parts” that cover various healthcare needs:

-

Part A (Hospital Insurance): Inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

-

Part B (Medical Insurance): Doctor visits, outpatient care, preventive services, lab work, and durable medical equipment.

-

Part C (Medicare Advantage): An alternative to Original Medicare offered by private insurance companies, often including Part A, Part B, and sometimes Part D.

-

Part D (Prescription Drug Coverage): Helps pay for prescription medications.

Who Qualifies for Medicare?

You’re eligible for Medicare at age 65 if you’re a U.S. citizen or legal permanent resident and have lived in the U.S. for at least five consecutive years. You may also qualify before 65 if you’ve been receiving Social Security Disability Insurance (SSDI) for at least 24 months or have been diagnosed with ESRD or ALS.

How and When to Enroll

Most people are automatically enrolled in Medicare Part A and Part B if they’re already receiving Social Security benefits. If not, you’ll need to sign up through the Social Security Administration.

Your Initial Enrollment Period (IEP) is a 7-month window: it starts 3 months before your 65th birthday, includes your birthday month, and ends 3 months after.

What Happens If You Don’t Enroll on Time?

If you delay enrolling in Medicare and don’t have creditable coverage, you could face lifelong late enrollment penalties for both Part B and Part D. These penalties are added to your monthly premiums and grow the longer you wait.

What If You Have Group or Union Coverage?

If you’re still working and have coverage through an employer or union (or your spouse does), you may be able to delay Medicare without penalty. But the rules can be tricky—especially if the employer has fewer than 20 employees. It’s important to confirm whether your current coverage is considered creditable by Medicare standards.

Once that group coverage ends, you typically have an 8-month Special Enrollment Period to sign up for Medicare without facing penalties.

What Does Medicare Cost?

Most people don’t pay a monthly premium for Part A because they or their spouse paid Medicare taxes for at least 10 years. If you haven’t worked enough to qualify, you may have to pay up to $505 per month for Part A in 2025.

For Part B, the standard monthly premium in 2025 is $185. However, higher-income individuals may pay more due to IRMAA (Income-Related Monthly Adjustment Amount), which is based on your tax return from two years prior. IRMAA may also apply to Part D.

Part D prescription drug coverage must be purchased separately, unless it’s included in a Medicare Advantage plan. Costs vary depending on the plan you choose, your medications, and whether you qualify for Extra Help.

In addition to premiums, Medicare may include deductibles, copays, and coinsurance. You may also have additional costs depending on whether you choose to enroll in a Medicare Supplement (Medigap) plan or a Medicare Advantage (Part C) plan. These plans can offer more predictable costs, but premiums and out-of-pocket responsibilities vary widely.

What Are My Medicare Coverage Options?

Once you’re enrolled in Medicare Parts A and B, you have two main ways to receive your benefits:

-

Original Medicare – This includes Part A and Part B. You can add a stand-alone Part D plan for prescription drug coverage and a Medicare Supplement (Medigap) policy to help pay your out-of-pocket costs like deductibles and coinsurance. Medigap policies are sold by private insurance companies and allow you to see any doctor who accepts Medicare.

-

Medicare Advantage (Part C) – These are all-in-one plans offered by private insurers that combine Part A, Part B, and often Part D. Many also include extra benefits like dental, vision, hearing, gym memberships, and more. However, these plans often use provider networks (like HMOs or PPOs), so you may be limited to doctors in the plan’s network.

Each option has pros and cons. Original Medicare offers nationwide access to providers and the ability to pair with a Medigap plan for more predictable out-of-pocket costs. Medicare Advantage plans can offer lower premiums and extra benefits, but you may face more restrictions on where and how you get care.

The right choice depends on your budget, health needs, prescription usage, and whether your doctors are in a plan’s network.

Final Thoughts

Whether you’re in Los Angeles, Ventura County, or anywhere else in California, understanding Medicare helps you make smarter healthcare decisions.

Want to avoid costly mistakes or confusion? Click the button below to schedule a free consultation with a California Medicare expert.

Not in California? I’m also licensed in Arizona, Florida, Georgia, Illinois, Michigan, Nevada, New Mexico, Oklahoma, and Texas and I’m happy to help wherever you're located.

—

FYInsurance Solutions – Coach. Strategize. Protect.