Medicare Part B: What It Covers, Costs, and When to Enroll

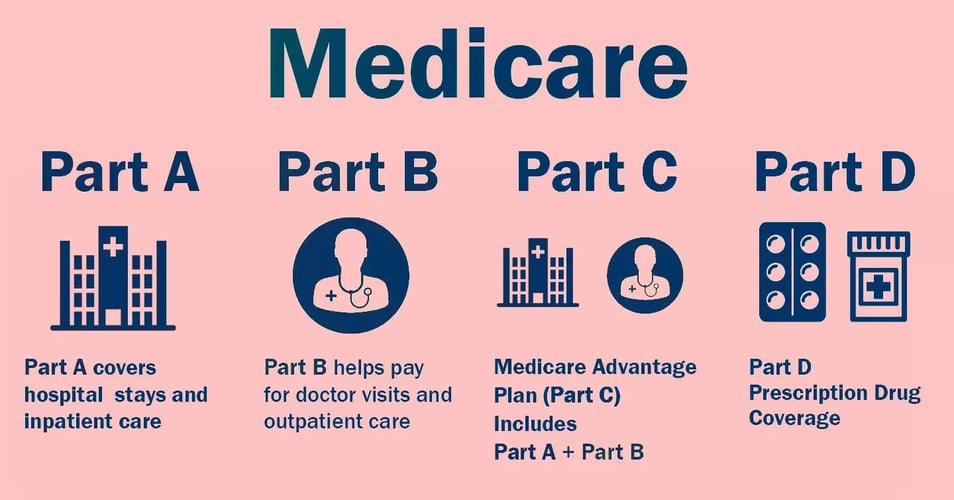

Medicare Part B is a key part of your health coverage once you are eligible for Medicare. While Part A covers hospital stays, Part B is your medical insurance, covering doctor visits, outpatient care, and preventive services.

Understanding what Part B offers, what it costs, and when to sign up can help you avoid late enrollment penalties and ensure you get the coverage you need.

What Is Medicare Part B?

Medicare Part B is the portion of Original Medicare that helps pay for:

-

Doctor and specialist visits

-

Preventive care (like screenings and vaccines)

-

Outpatient services

-

Lab tests and X-rays

-

Durable medical equipment (like wheelchairs and walkers)

-

Mental health services

Together with Part A, it forms the core of your Medicare benefits.

How Do You Get Medicare Part B?

If you are already receiving Social Security or Railroad Retirement Board benefits, you will be enrolled in Part B automatically when you turn 65.

If not, you’ll need to enroll through the Social Security Administration during your Initial Enrollment Period which begins 3 months before your 65th birthday, includes your birthday month, and extends 3 months after.

What Does Medicare Part B Cost in 2025?

Most individuals pay a standard monthly premium for Part B. In 2025, the base premium is set at $185.00 per month. However, if your income surpasses certain limits, your actual monthly premium could be higher. This is where the Income-Related Monthly Adjustment Amount (IRMAA) comes into play.

Additionally, there is an annual deductible of $257. After meeting this deductible, you typically pay 20% of the Medicare-approved amount for most services covered under Part B. This includes visits to doctors, outpatient therapy, and durable medical equipment. Some preventive services might be fully covered, while certain services, such as outpatient surgery, may incur a higher copay depending on the timing of the treatment.

What Is IRMAA and How Can It Affect You?

IRMAA is an additional charge added to your Part B (and Part D) premium if your modified adjusted gross income (MAGI) is above a certain level. For 2025, this income is based on your 2023 tax return. The higher your income, the more you pay.

Even if your income has recently dropped, IRMAA still applies unless you file an appeal and qualify for a reduction.

Late Enrollment Penalty for Part B

If you do not enroll in Part B when you’re first eligible and you do not have creditable coverage, you could face a late enrollment penalty; a 10% increase in your premium for each 12-month period you delayed, applied for life.

What Counts as Creditable Coverage?

You can delay enrolling in Part B without penalty if you have creditable coverage, for example, through a current employer. Once that coverage ends, you have an 8-month Special Enrollment Period to sign up.

Final Thoughts

Medicare Part B is essential to your overall healthcare coverage. It covers many of the services you’ll use most often and signing up on time can save you money and stress later.

Have questions about your eligibility, IRMAA, or how to coordinate Part B with other coverage? Click the button below to speak with our Medicare experts who can walk you through your next steps.