If you're exploring Medicare options in California, you've likely heard of Medicare Advantage, also known as Part C. This blog breaks down what it is, how it works, and whether it might be the right fit for your healthcare needs.

What Is Medicare Advantage?

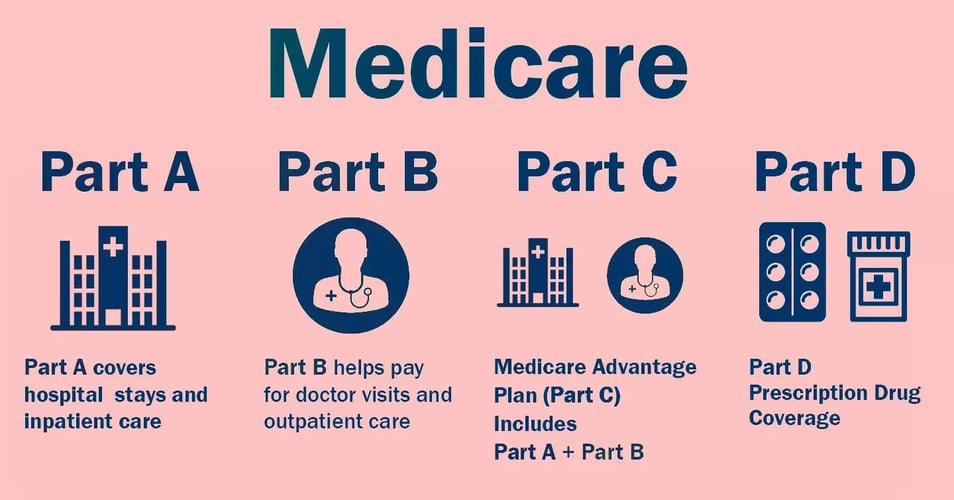

Medicare Advantage (MA), also called Medicare Part C, is a bundled alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and must cover at least everything Original Medicare does (Parts A and B). Most also include Part D (prescription drug coverage) and offer extras like dental, vision, hearing, transportation, or even gym memberships.

Why It's Called "Part C"

Medicare Advantage is called Part C because it combines Part A (hospital insurance) and Part B (medical insurance) into one plan. Many plans also add Part D, giving you comprehensive medical and prescription coverage in a single policy.

Medicare Advantage vs. Original Medicare

When choosing between Original Medicare and Medicare Advantage, it's essential to consider how each one works in terms of coverage, flexibility, and out-of-pocket costs. Here's a quick comparison to help you decide what might work best for your needs:

| Feature |

Original Medicare |

Medicare Advantage |

| Coverage |

Part A + Part B |

Part A + Part B + Often Part D |

| Provider Access |

Any provider accepting Medicare |

Limited to plan network (HMO/PPO) |

| Referrals Needed |

No |

Usually required with HMOs |

| Prescription Drugs |

Not included (must buy Part D separately) |

Included in most plans (MAPD) |

| Extra Benefits |

Not included |

May include dental, vision, hearing, fitness, etc. |

| Monthly Premiums |

Standard Part B premium |

Often lower or $0 |

| Out-of-Pocket Costs |

Can be lower with Medigap |

Annual max limit protects spending |

Types of Medicare Advantage Plans

-

HMO (Health Maintenance Organization): Requires you to use in-network providers and usually needs referrals to see specialists.

-

HMO-POS (Point-of-Service): An HMO plan that may allow limited out-of-network care for a higher cost.

-

PPO (Preferred Provider Organization): Offers more provider flexibility but at higher costs for out-of-network care.

-

PFFS (Private Fee-for-Service): You can see any provider that agrees to the plan's terms.

-

MSA (Medical Savings Account): Combines a high-deductible plan with a Medicare-funded savings account you can use for medical expenses.

-

SNP (Special Needs Plan): Designed for people with specific diseases, low incomes, or who live in institutions.

Who Can Enroll in Medicare Advantage?

To qualify, you must:

-

Be enrolled in both Medicare Part A and Part B

-

Live in the plan's service area

-

Be a U.S. citizen or lawfully present in the U.S.

Enrollment Periods for Medicare Advantage

-

Initial Coverage Election Period (ICEP): Begins when you’re first eligible for Medicare and have enrolled in Part A and B.

-

Annual Enrollment Period (AEP): October 15 to December 7. You can join, switch, or drop plans.

-

Medicare Advantage Open Enrollment: January 1 to March 31. Allows you to switch MA plans or return to Original Medicare.

-

Special Enrollment Periods (SEPs): Triggered by life events like moving, losing other coverage, or qualifying for Extra Help.

Potential Restrictions to Know

-

Networks: Most plans limit you to a network of providers.

-

Prior Authorizations: Some services require approval in advance.

-

Referrals: HMO plans often require referrals to see specialists.

Pros and Cons of Medicare Advantage

Pros:

-

Lower premiums (sometimes $0/month)

-

All-in-one coverage

-

Extra benefits not offered by Original Medicare

-

Annual maximum out-of-pocket limit may help protect your budget

Cons:

Final Thoughts

If you want bundled coverage, extra benefits, and are comfortable with more restrictive provider networks, Medicare Advantage may be a great fit. But it’s important to compare plan details carefully.

Ready to see if Medicare Advantage is right for you? Click the button below to schedule your free Medicare consult.