Understanding IRMAA in 2025: What Medicare Beneficiaries Need to Know

Are you approaching Medicare eligibility or currently enrolled? You might have encountered the term IRMAA, Income-Related Monthly Adjustment Amount. This guide provides essential information about IRMAA, how it's calculated, who pays it, and the current income brackets for 2025.

What is IRMAA?

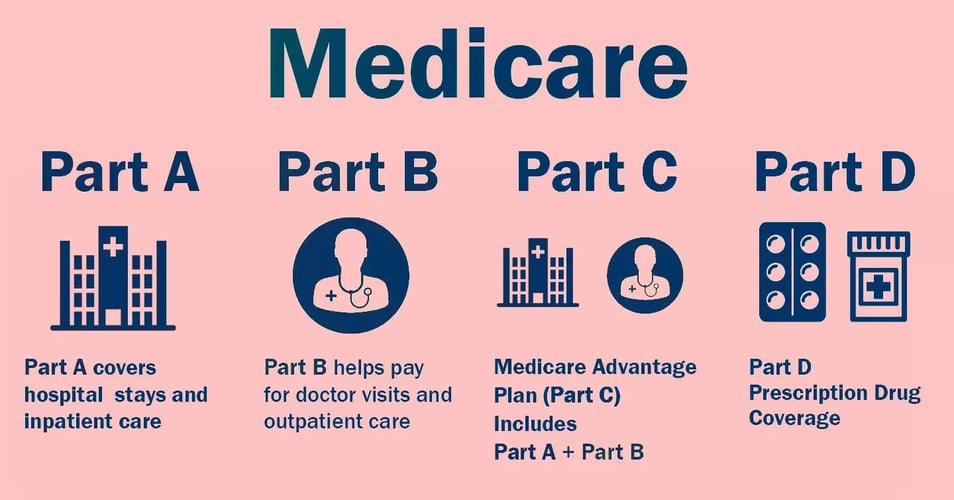

IRMAA stands for Income-Related Monthly Adjustment Amount. It's an additional surcharge that higher-income Medicare beneficiaries pay on top of the standard Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) premiums. This surcharge is based on your modified adjusted gross income (MAGI).

How is IRMAA Calculated?

Your IRMAA payment is determined using your income reported from two years earlier. For instance, your 2025 IRMAA is calculated based on your 2023 tax return. The Social Security Administration (SSA) evaluates your income information annually and sends notifications if you're subject to IRMAA surcharges.

Who Needs to Pay IRMAA?

IRMAA affects individuals and couples whose incomes surpass specific thresholds. Generally, higher-income Medicare beneficiaries must pay this surcharge. If your MAGI exceeds these thresholds, you will receive an official notice from the SSA.

IRMAA Brackets for 2025 (Based on 2023 Income)

Here are the income brackets and corresponding premiums for 2025:

SINGLE |

MARRIED FILING JOINTLY |

MARRIED FILING SEPARATELY |

PART B PREMIUM* |

PARD D IRMAA |

|

$106,000 or less |

$212,000 or less | $106,000 or less | $185 | $0 + your plan premium |

| Above $106,000 up to $133,000 | Above $212,000 up to $266,000 | $259 | $13.70 + your plan premium | |

| Above $133,000 up to $167,000 | Above $266,000 up to $334,000 |

$370 |

$35.30 + your plan premium | |

| Above $167,000 up to $200,000 | Above $334,000 up to $400,000 | $480.90 | $57 + your plan premium | |

| Above $200,000 and less than $500,000 | Above $386,000 and less than $750,000 | Above $106,000 and less than $394,000 | $591.90 | $78.60 + your plan premium |

| $500,000 and above | $750,000 and above | $394,000 and above | $628.90 | $85.80 + your plan premium |

Figure 1. 2025 IRMAA, graph created by author based on data adapted from 2025 Medicare Part A & B Premiums and Deductibles, CMS, 2025

* Note: If you pay a Medicare late enrollment penalty, these amounts will be higher.

When is IRMAA Paid?

Typically, IRMAA payments are deducted directly from your Social Security check if you are receiving benefits. If you are not receiving benefits, Medicare will bill you directly. Payments are monthly and align with your standard Medicare premium schedule.

What If Your Income Changes?

Life changes such as retirement, divorce, or loss of a spouse can significantly affect your income. If this occurs, you may appeal your IRMAA determination to the SSA for a reassessment.

Plan Ahead for Your Medicare Costs

Understanding IRMAA and proactively planning your retirement finances can prevent unexpected costs and help you effectively manage your Medicare budget.

Have more questions about IRMAA or need assistance with Medicare planning? Contact us today for personalized support!